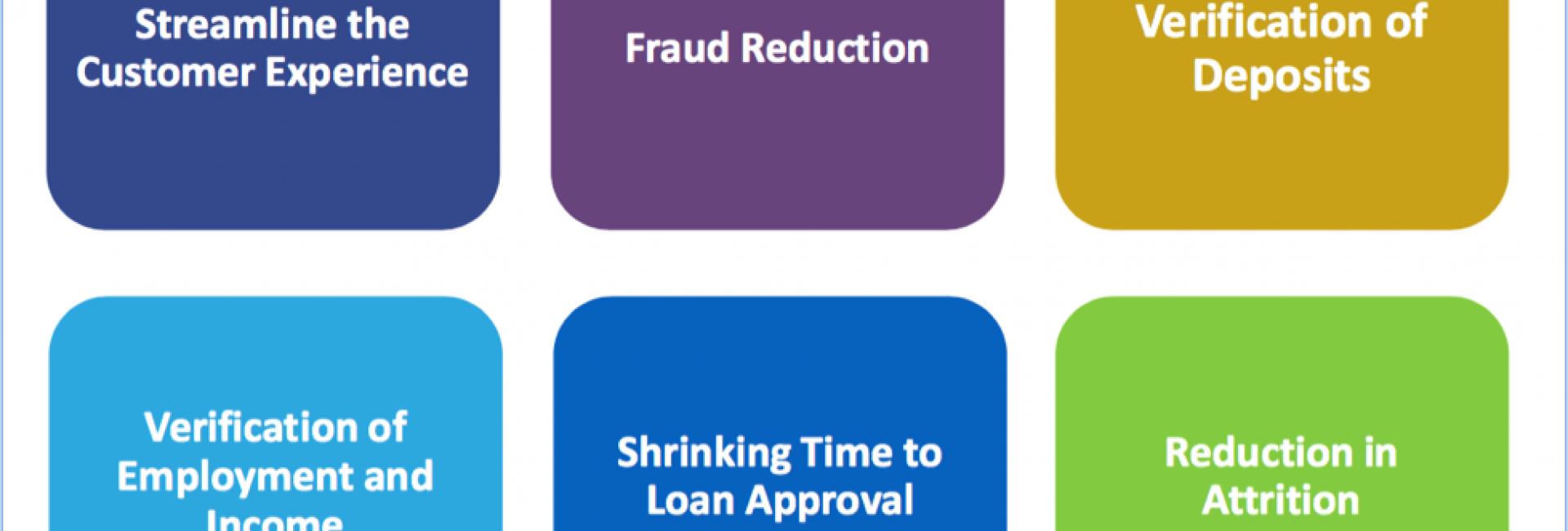

Envestnet® | Yodlee® and American Banker recently hosted a webinar on how to leverage technology and data to drive profitability in lending – led by Christine Pratt, senior analyst for Aite Group and Terry McKeown, practice manager for Envestnet | Yodlee, and moderated by journalist Michael Sisk, editor-at-large for American Banker. In the webinar, Pratt and McKeown discussed some of the trends and technology that are changing the lending landscape. We also shared what financial institutions can do to compete and win, as well as how to leverage aggregated data feeds to improve customer service and deliver a more streamlined lending experience. Pratt started things off by sharing the state of the U.S. retail and small business lending market, and gave attendees some ideas about what's coming next. She said that as the number of consumer loans decreases — especially real estate loans — regulators must shoulder the blame for the reduced number of loans. The increased demands for compliance and transparency have resulted in more paperwork and longer wait times. New regulations have also had a severe impact to IT and operational resources, trying to implement new rules and guidance. And, Pratt believes it's only going to get worse in the next two years. As a result, says Pratt, many banks and lending institutions are trying to simplify the borrowing process, making it as easy as possible. They're even looking at new sources of information, such as digital and social media data, for determining the viability of loan applicants. Of course, this is a hard sell, as many financial institution executives are leery of many new data sources and systems, and they stress the need for having trustworthy data. Our own Terry McKeown picked up where Pratt left off, showing attendees how Envestnet | Yodlee solutions help financial institutions build a more comprehensive view of client’s financial situation with as much trustworthy data about the borrow as possible, including non-credit accounts. All of this data can help lenders gain better insights about potential borrowers and reduce credit risk. Many financial institutions offering lending products are looking for a 360-degree view of consumers and small businesses, and Envestnet | Yodlee is able to securely pull data from billions of transactions from 14,000+ financial data sources. In addition, data can be provided in a format that’s easily used in lending platforms and/or data models. For more insights on trends and technologies driving change in lending, feel free to view the on-demand webinar or download the presentation slides.