Transaction Data Insights for Investment Decisions

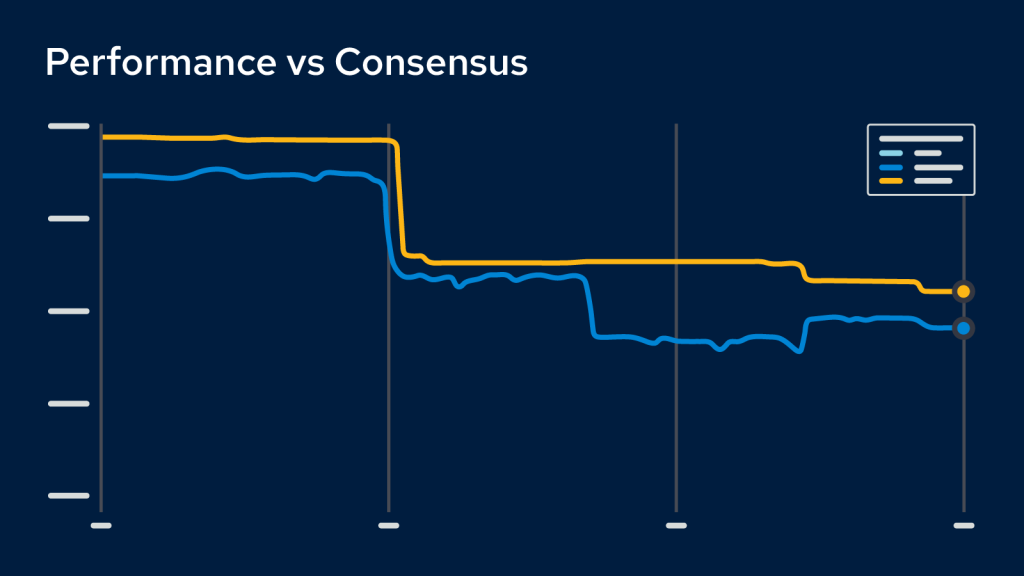

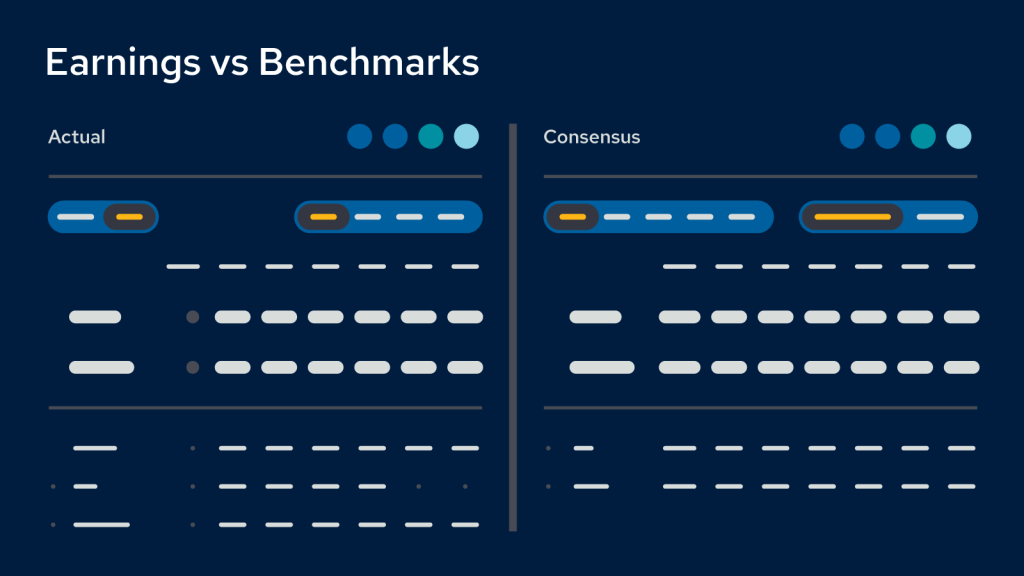

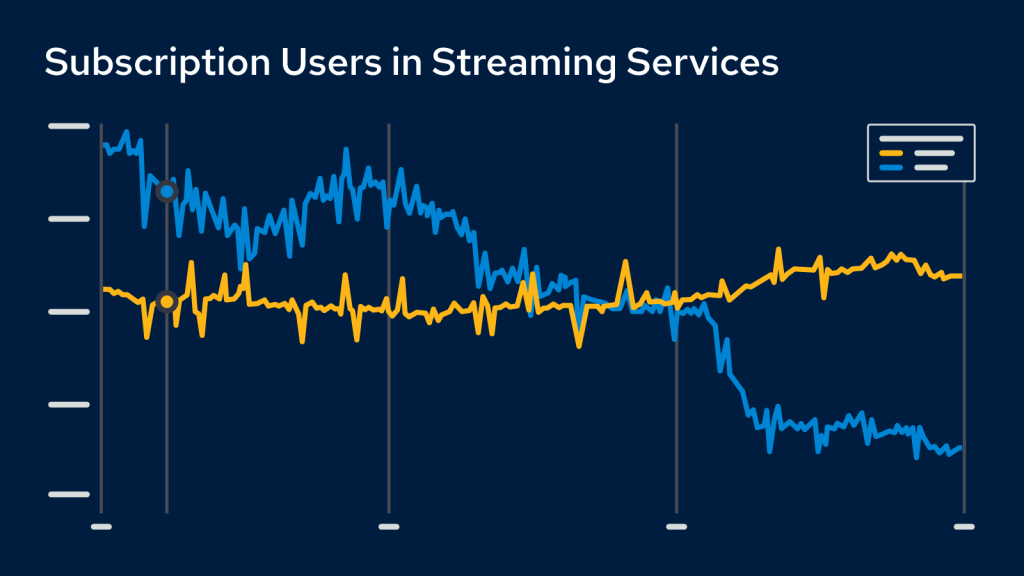

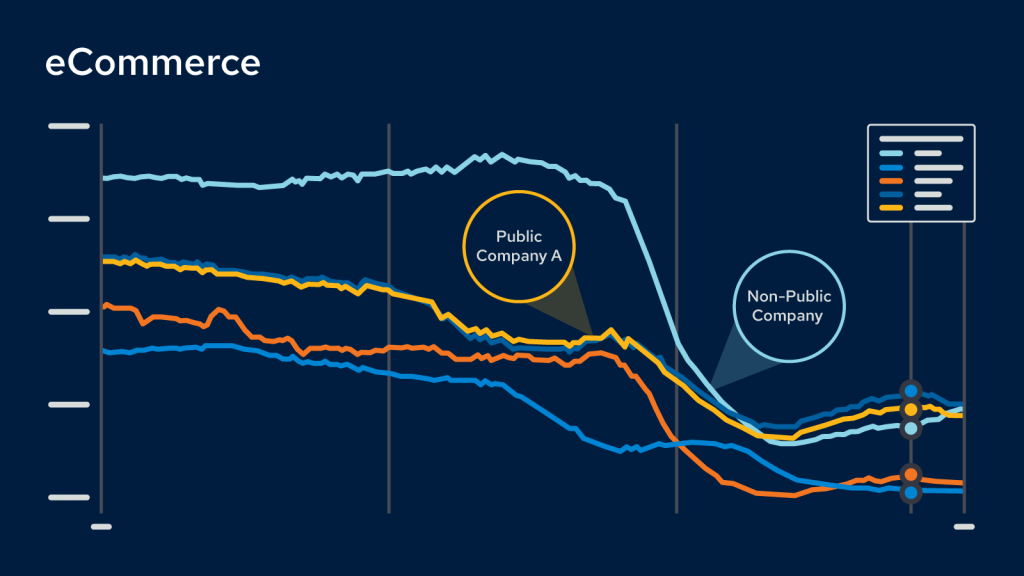

By leveraging de-identified spending and income data, investment and portfolio managers can discover new growth opportunities, determine risk, create benchmarks for peer comparison, and take action to potentially drive greater returns on their investments.

Investor Data

Signals Powered by Data Analytics in Investment Management

Envestnet | Yodlee's data aggregation empowers organizations with extensive access to de-identified spending data, encompassing billions of transactions that span trillions in expenditures. This unparalleled reach equips investors with detailed and accurate information essential for informed decision-making and strategic actions.

Signals for investment decision-making

Gain the Edge with Timely, Accurate Investor Intelligence

Envestnet | Yodlee transaction data is your gateway to unmatched competitive intelligence and market visibility, ensuring you're always one step ahead in your decision-making. Our de-identified spending data provides a panoramic view of the dynamic market landscape, enabling you to spot emerging trends with unwavering clarity. Stay ahead of the curve, stay ahead in the game.

Industries

Transaction data across sectors

Harness the potential of deidentified spending data across diverse industries. Our data analytics solution empowers investors across all sectors to conduct code-free data analysis. The extensive dataset delves into over 60 industries at a detailed level, providing valuable insights into competitive advantages, cross-industry dynamics, macro indicators, and the intricate impacts of geographic factors.

Data Analytics Blog

Stay Informed with Fresh Signals from Transaction Data

Transaction data is an invaluable resource for investment managers, quantitative researchers, and portfolio managers. Explore Envestnet | Yodlee's Data Analytics blog to uncover glimpses of consumer spending trends and our expert interpretations.

Get Started With Investor Data Analytics

Sift through market noise with Envestnet | Yodlee transaction data to uncover and act on valuable signals for investment decision making.

Get Started