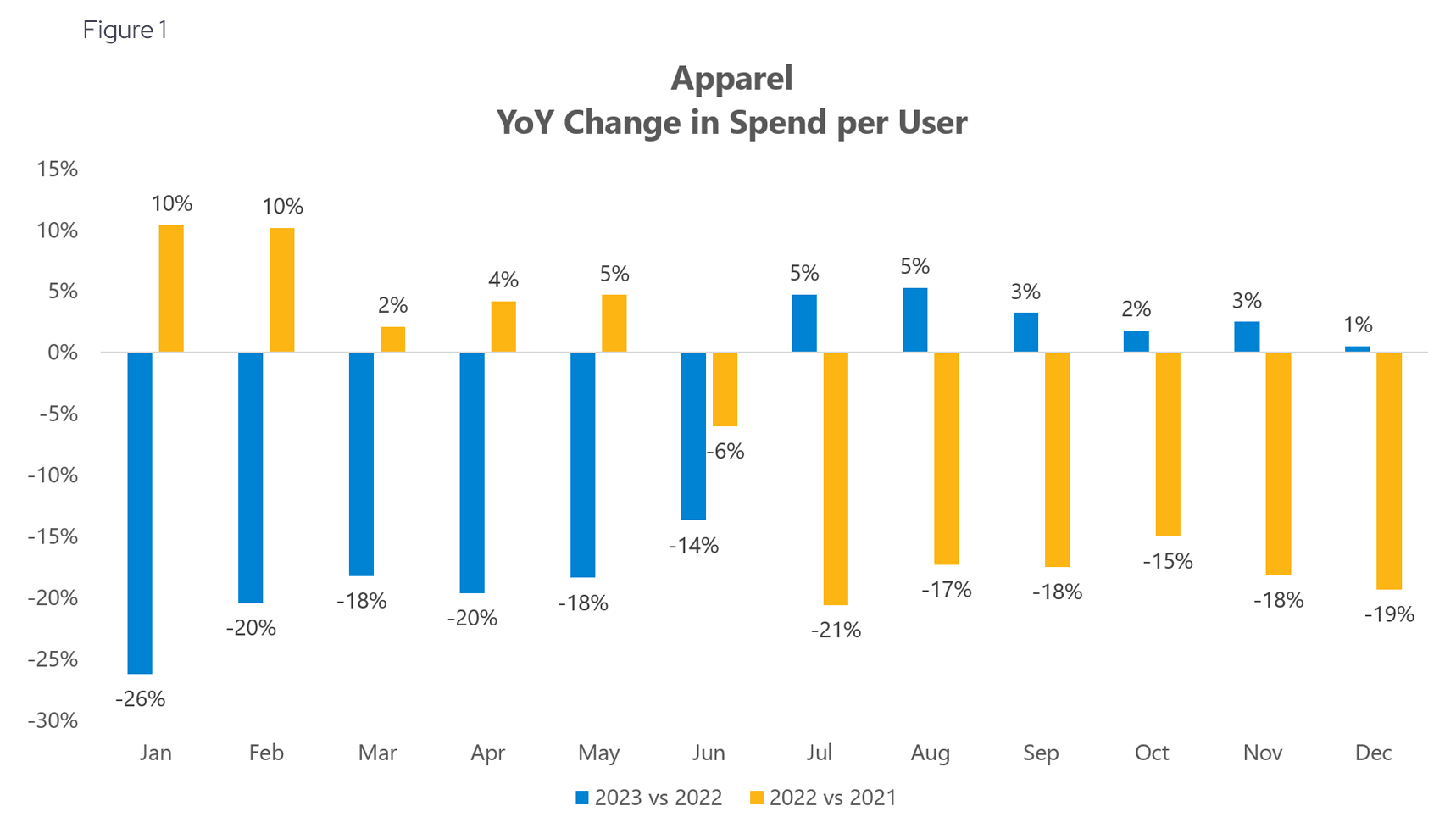

Apparel spending decreased in the first half of 2023 but rebounded in the second half

Envestnet® | Yodlee® data shows that consumer spending on apparel decreased for every month on a year-over-year comparison in the first part of 2023. The beginning of the year reflected the largest drop, when January year over year spend fell as much as 26% compared to 2022 (see Figure 1). Starting in July, growth went into positive territory where it remained for the rest of the year.

According to an article from Statistica, there was an overall increase in clothing store sales in 2023 compared to the previous year. For instance, in June 2023, clothing store sales were estimated to reach roughly 18 billion U.S. dollars, which was slightly higher than that achieved over the same period of 2022. While the specific year-over-year comparison is not explicitly stated, these figures suggest a positive trend in consumer spending in apparel stores during 2023.

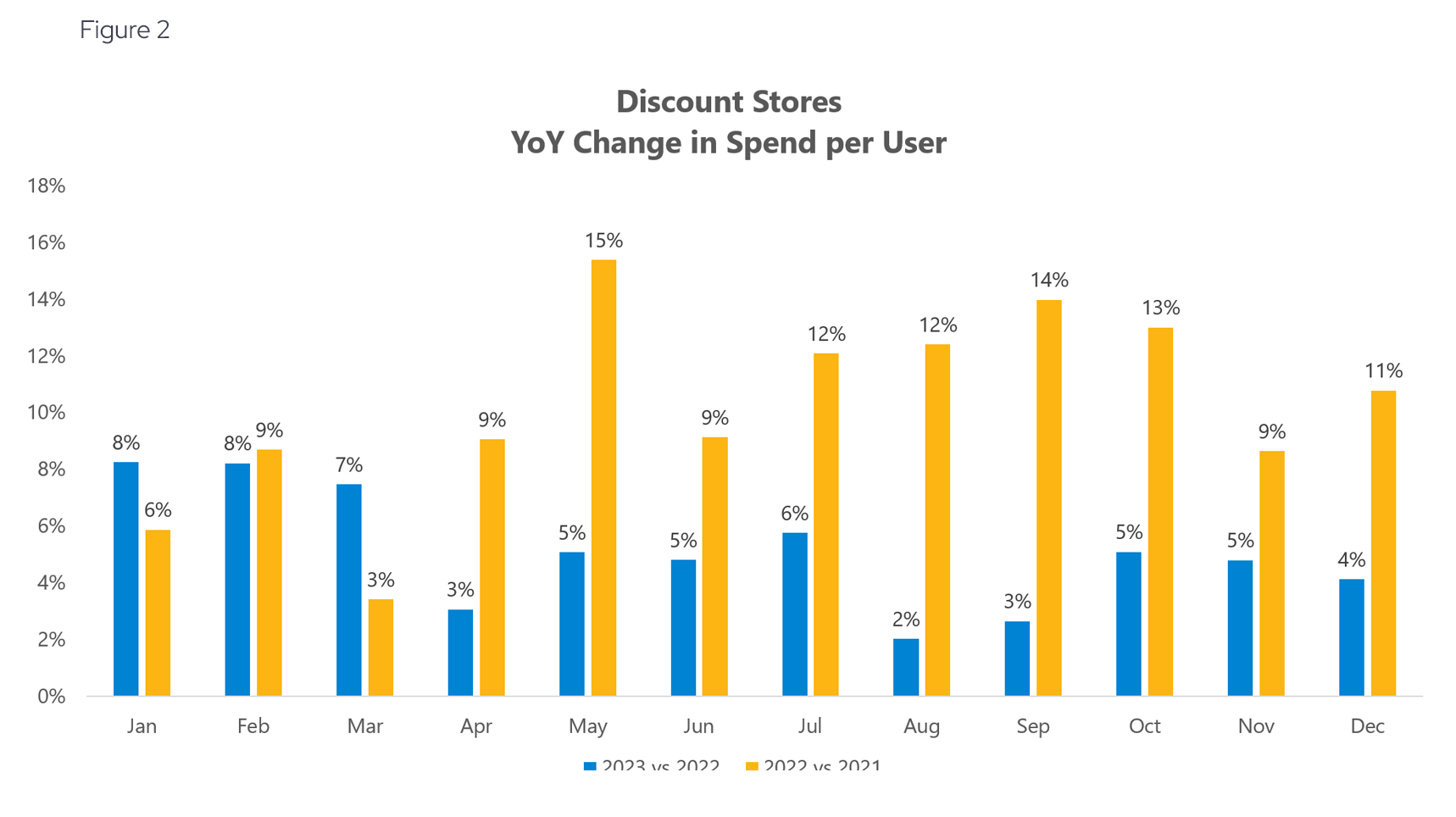

Discount store spending increases throughout all of 2023

Envestnet® | Yodlee® data shows that spending at discount stores increased year-over-year throughout all of 2023 with the highest increases occurring in the first quarter of the year (see Figure 3). Growth slowed in August and September then rose again during the holiday season in the last quarter of the year.

An article from the National Retail Federation forecasted retail sales were expected to grow between 4% and 6% in 2023 compared to 2022. NRF's Chief Economist, Jack Kleinhenz, mentioned that consumers were resilient in 2023 despite various economic challenges and were expected to look for deals and discounts to stretch their dollars during the holiday season, which could explain the increase in spending at discount stores.

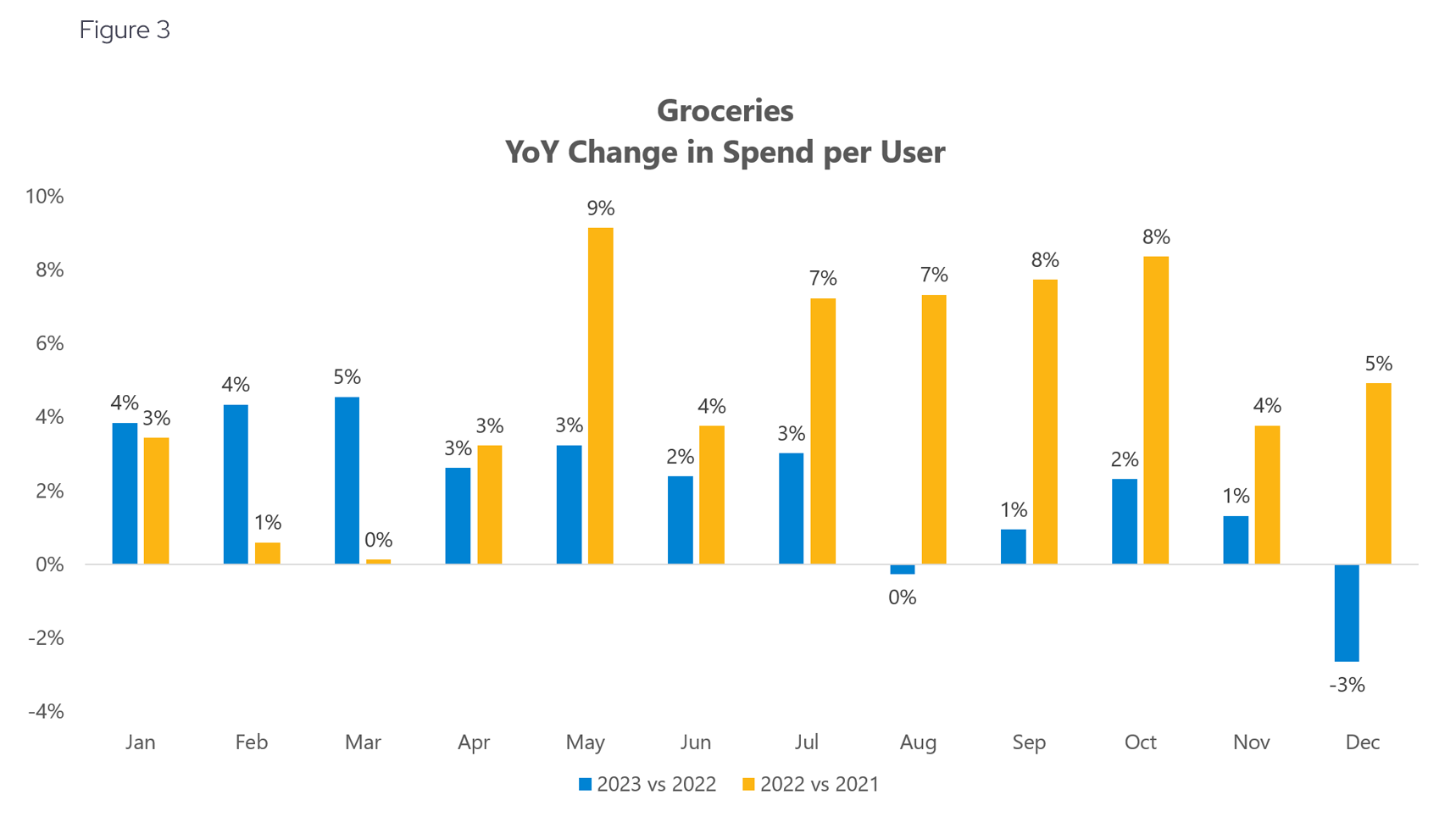

Grocery store spending increased during most of 2023

Envestnet® | Yodlee® data shows that spending at grocery stores increased through most of 2023 as compared to 2022 (see Figure 4). Exceptions occurred in August when spending in 2023 was equal to that in 2022 and in December when spending dropped 3% less versus 2022. The highest increases occurred in the first quarter of the year.

According McKinsey’s Consumer Pulse Survey, consumer spending in grocery stores saw a significant increase in 2023 with two-thirds of respondents stating they spent significantly more on groceries in the past year, and nearly 60% of respondents stating that grocery spending represented a significantly higher share of their overall spending.

Want to get ahead of consumer spending trends?

Subscribe to our research data blog for ongoing updates or reach out for a personalized, up-to-date view of Yodlee consumer spending data.

About Envestnet | Yodlee Merchant, Retail, Shopper, and Spend Insights

Envestnet | Yodlee Merchant, Retail, Shopper, and Spend Insights utilize de-identified transaction data from a diverse and dynamic set of data from millions of accounts to identify patterns and context to inform spending and income trends. The trends reflect analysis and insights from the Envestnet | Yodlee data analysis team. By combining data with intelligence – connecting vast amounts of actual de-identified shopping data with state-of-the-art analytics and machine learning – Envestnet | Yodlee provides visibility into a large set of shopping daily purchase behavior including, but not limited to, transactions, customer lifetime values, and merchant/retailer shares.

To learn more about Envestnet | Yodlee Merchant and Retail Insights and get a free demo, please contact an Envestnet | Yodlee sales representative.