Envestnet | Yodlee Security Normalization

Identify Security Holdings

Our one-of-a-kind normalization and enrichment process accurately identifies security holdings and increases data population rates. With the ability to view complete and clear information associated with securities, you can intelligently analyze investors’ holdings and deliver more strategic financial guidance.

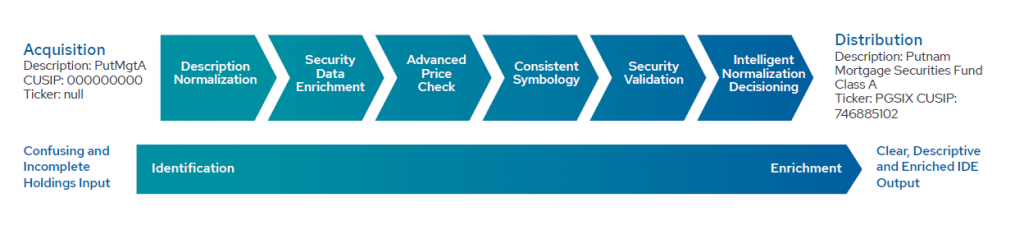

From Identification to Enrichment

Key Benefits

Through data science and deep learning, our multi-step enrichment process translates partial security data into rich meaningful holdings for a more complete financial picture.

Reduced Operational Overhead

Less manual intervention is needed to maintain reporting and trading platforms

Market Leading Accuracy

Higher population rate and accuracy for security style, type, and classifications

Specialized Wealth Data

Greater identification and accuracy in complex wealth use-cases including options, preferred stocks, MBS, Collective Investment Trusts, and more

Broad Access

Access to Envestnet | Yodlee’s extensive proprietary security master with multiple industry sources and exchanges provides the most up to date security information

Holistic Financial View

Consistent symbology across financial accounts and institutions supports a unified, holistic view of investors’ finances

Intelligent Algorithm

Our machine learning algorithm identifies and enriches securities and holdings with complete descriptions, ticker, and CUSIP values

Data Science & Deep Learning

What is Security Normalization?

When complete security data isn’t provided, Envestnet | Yodlee Security Normalization helps identify the correct securities and fill in the gaps.

How Does Security Normalization Work?

Leveraging data science and deep learning, security normalization uses the incomplete source information aggregated from an account and cycles it through a series of identification and matching algorithms to provide the most complete security data. All positions aggregated from the investor’s account are normalized, and missing information is updated and enriched with complete descriptions, ticker, and CUSIP values.

Security normalization enables investors to see a consistent record of their security holdings, regardless of the financial institution, and helps to improve the comprehensive financial view.