Why Banking APIs are Crucial for Modern Financial Services

In recent years, banking application programming interfaces (APIs) have gained significant traction, transforming the banking industry. According to a recent McKinsey survey, 88% of banking respondents believe APIs have become more important over the past two years. Moreover, 81% consider APIs a priority for both business and IT functions. This growing emphasis underscores the pivotal role APIs play in enhancing customer experiences, driving innovation, and improving operational efficiency within financial institutions.

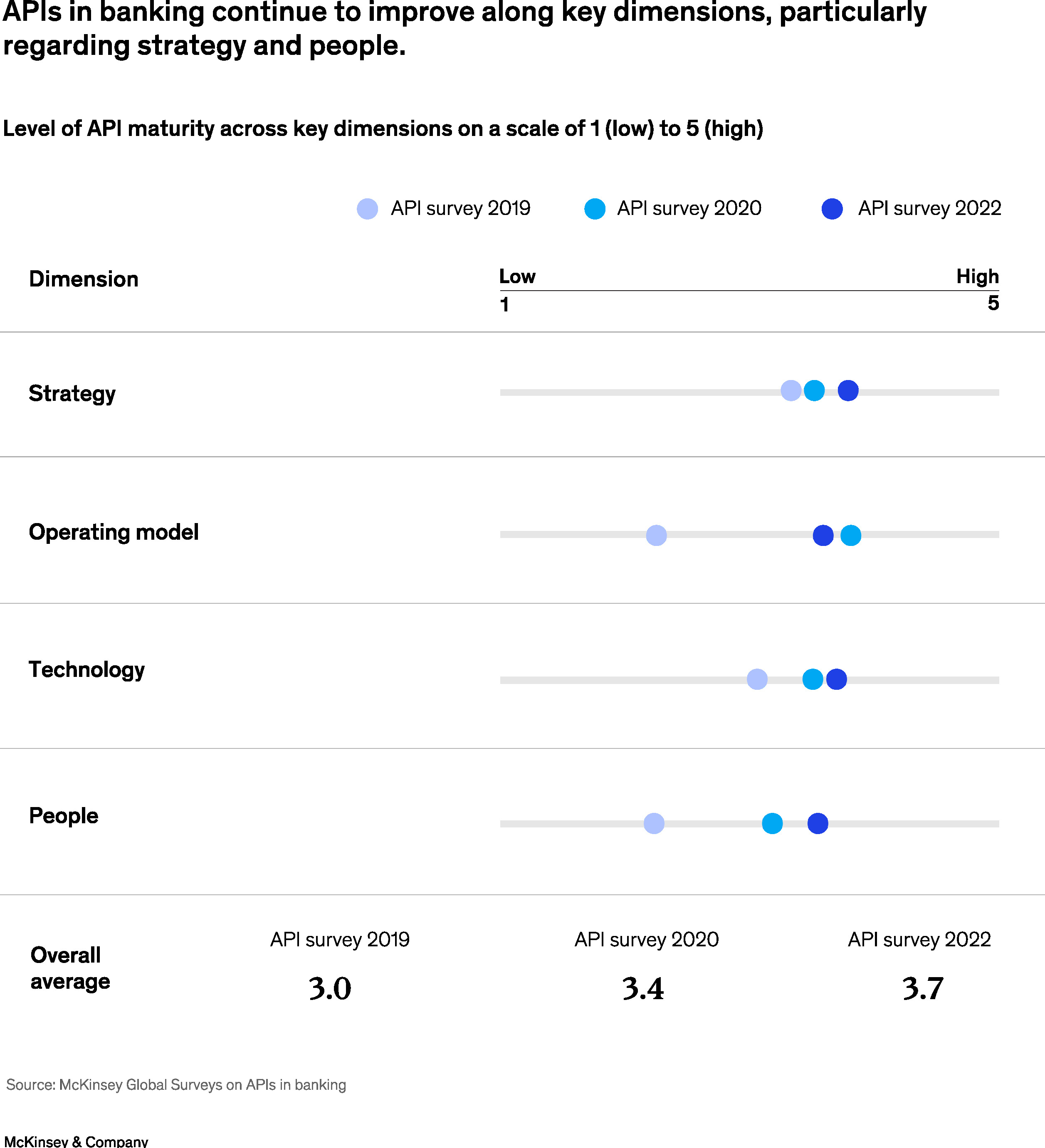

The survey also found that banks are steadily improving their API maturity across strategic, technological, and personnel dimensions (see Exhibit 1). APIs are not only easy, fast, and secure ways for customers to access banking services, but they are also versatile tools. Financial institutions are increasingly deploying APIs across traditional business areas and new domains such as banking as a service, platform as a service, and embedded finance. While APIs are essential for future technological architectures, financial-sector executives must ensure their organizations have a clear strategy to maximize their potential.

How Bank APIs Are Being Used in Financial Services

APIs have revolutionized the financial services industry by enabling seamless integration and interaction between various systems and platforms. Here are some of the key ways APIs are being utilized in the sector:

Enhanced Customer Experience

- Personalized Services: APIs enable banks to offer tailored financial products and services based on individual customer needs, enhancing personalization and customer satisfaction.

- Unified Platforms: Customers can access banking services, such as account management, payments, and investments, through a single platform, thanks to API integration.

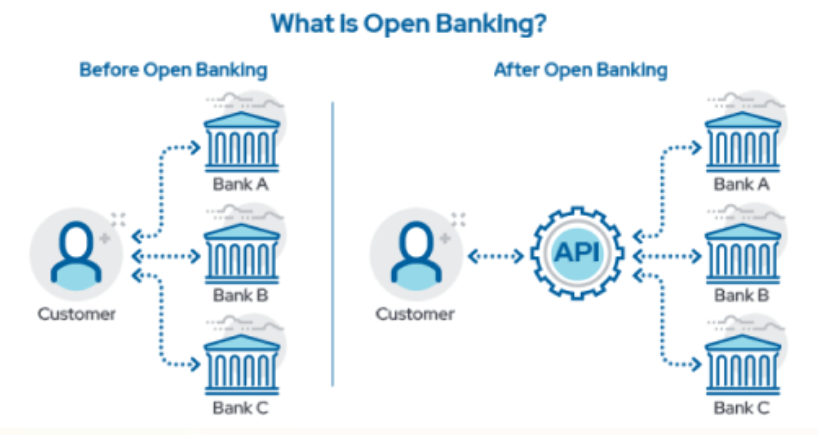

Open Banking

- Data Sharing: APIs facilitate the secure sharing of customer data between banks and third-party providers, fostering innovation and competition in financial services.

- Third-Party Applications: Open banking APIs allow third-party developers to create applications that offer additional value to customers, such as budgeting tools, loan comparison services, and more.

Real-Time Payments and Transfers

- Instant Transactions: APIs enable real-time payments and fund transfers, providing customers with faster and more efficient transaction processes.

- Seamless Integration: Payment APIs integrate with various payment gateways and platforms, simplifying the payment process for both businesses and customers.

Automated Lending and Credit Scoring

- Quick Assessments: APIs can pull data from multiple sources to quickly supplement creditworthiness assessments, streamlining the loan approval process.

- Alternative Data: By leveraging alternative data sources, APIs help lenders make more informed lending decisions based on a holistic view of their customers, particularly for customers with limited credit histories.

Investment and Wealth Management

- Portfolio Management: APIs provide real-time data and analytics for managing investment portfolios, helping advisors make informed decisions.

- Robo-Advisors: Automated investment platforms use APIs to offer personalized investment advice and portfolio management services.

Embedded Finance

- Banking-as-a-Service (BaaS): APIs allow non-bank companies to offer banking services, such as loans and payments, directly within their own platforms.

- Platform-as-a-Service (PaaS): Financial institutions can use APIs to offer their services on third-party platforms, expanding their reach and customer base.

Benefits of APIs for Banking

The best APIs enable banks and fintechs to power frictionless customer experiences and streamline tedious onboarding tasks. They also utilize data feeds for account verification, data aggregation, data enrichment, payment services, open banking, account aggregation, and more. Banking APIs can assist with everything from obtaining a holistic picture of a client’s financial situation, to verifying users’ account info to prevent fraud, to uncovering financial insights for more strategic financial advice.

Increased Operational Efficiency

By automating repetitive tasks and reducing manual work, APIs minimize errors and streamline various systems and platforms, leading to improved overall operational efficiency.

Greater Innovation and Agility

APIs allow financial service providers to quickly develop and deploy new financial products and services, staying ahead of market trends. They provide the flexibility to integrate with new technologies and platforms, fostering continuous innovation.

Improved Data Access and Utilization

APIs enable real-time access to data, allowing financial service providers to make informed decisions swiftly. By consolidating data from multiple sources, APIs enhance data analysis and insights.

Enhanced Security and Compliance

APIs ensure secure and encrypted data transmission, protecting sensitive customer information. They also help financial service providers comply with regulatory requirements by automating data reporting and monitoring transactions.

Navigating Open Banking Regulations with APIs

With the rise of open banking regulations, APIs have become essential for all financial service providers. These regulations mandate secure and standardized data sharing between banks and third-party providers to foster innovation and competition. APIs facilitate this seamless data exchange, ensuring compliance with regulations such as PSD2 in Europe and similar frameworks worldwide. By adopting APIs, financial service providers can not only meet regulatory requirements but also unlock new opportunities for growth and collaboration in the financial ecosystem. Embracing API technology is crucial for staying compliant and competitive in today's dynamic financial landscape.

Are You Ready to Transform Your API Strategy?

As you plan your API strategy and transformation, it is crucial to align the API strategy with overall business goals, ensuring that APIs drive value in areas like customer experience, operational efficiency, and new business models. Security and compliance are paramount, requiring robust security measures and adherence to regulatory frameworks like GDPR and PSD2. Scalability and flexibility must be built into the API architecture to handle growing transaction volumes and integrate future innovations seamlessly.

Additionally, fostering a positive developer experience through comprehensive documentation and support is essential for successful API adoption. Effective data management practices ensure that the data shared through APIs is accurate and reliable. Continuous monitoring of API performance helps maintain service levels and optimize user experience. Fostering collaboration with third-party developers and fintechs can lead to new opportunities and expanded service offerings. Lastly, investing in change management and training initiatives ensures a smooth transition, promoting a culture of innovation and addressing resistance to change. By considering these factors, financial service providers can develop a robust API strategy that drives growth and innovation while ensuring compliance and security.

Get Started with Banking APIs by Yodlee

Yodlee, a leader in data aggregation and analytics, offers robust banking APIs that empower financial service providers to innovate and excel in the competitive financial landscape. With Yodlee's comprehensive API solutions, financial service providers can seamlessly integrate a wide array of financial services, enhance data access and utilization, and ensure top-notch security and compliance. Yodlee's APIs are designed for scalability and flexibility, allowing institutions to adapt to evolving market demands and technological advancements. Additionally, Yodlee provides extensive support and resources, including detailed documentation and developer tools, to ensure a smooth integration process. By leveraging Yodlee's expertise and cutting-edge technology, financial institutions can drive operational efficiency, deliver superior customer experiences, and stay ahead in the rapidly changing financial sector.

Contact us to start experiencing the future of banking today.

Footnotes:

2https://www.treasuryprime.com/blog/embedded-payments

3https://fintechmagazine.com/banking/six-examples-embedded-finance-changing-future