Envestnet | Yodlee Transaction Data Enrichment

Clean, Meaningful Transaction Data

Envestnet | Yodlee Transaction Data Enrichment turns ambiguous raw transaction-based data into clear, easy-to-use contextualized data, allowing financial institutions to extract deep insights into customer needs and behaviors while enabling them to improve the customer experience journey and deepen engagement.

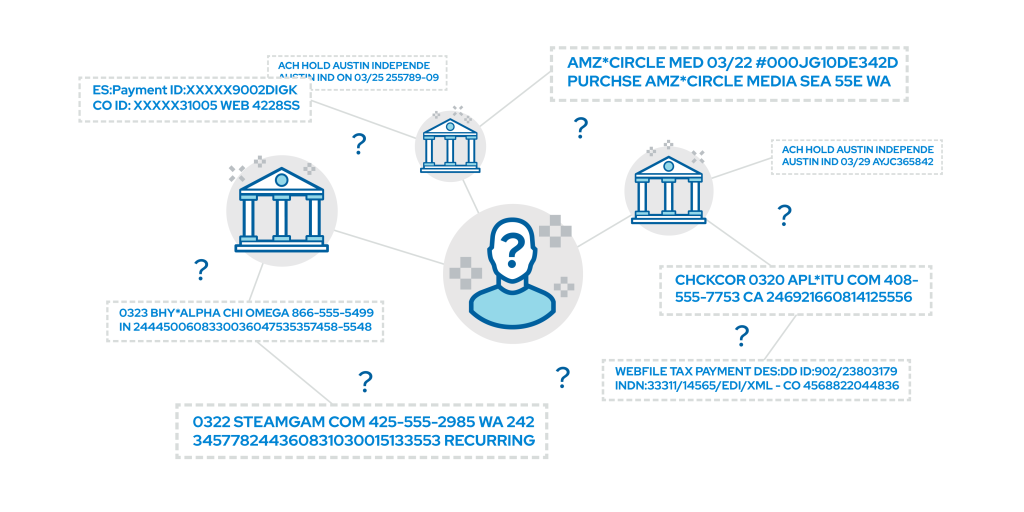

Uncover the Meaning Behind the Transactions

Key Benefits

Consumer transactions are insightful data that institutions can harness to learn about and better serve their customers, and Envestnet | Yodlee’s data science makes this data easier to understand, delivering benefits for consumers and companies alike.

Harness Data Utility

Data science algorithm, machine learning, and human curation boost accuracy and produce clear, concise, easy-to-use transaction analytics

Offer Personalized Services

Tap data insights to craft offers, increase engagement, drive conversion, and provide impactful financial wellness solutions

Improve Client Experience

Leverage clean data to deliver custom financial advice while driving down costs in call centers and service organizations

Understand Share of Wallet

Use card transaction data to provide rich insights into customer share of wallet and spending behavior

Leverage Clarified Transactions

Clean and contextualized data can help lower fraud research and customer support costs and frustrations associated with messy, unrecognizable data

Transaction Data Enrichment Video

Correct, Normalize, and Enrich Data

Transaction Data Enrichment turns ambiguous information into clear, contextualized data using sophisticated artificial intelligence and machine learning to achieve industry-leading accuracy across a wide range of account and transaction types.

Related Content

Data Enrichment Materials

Leading the Industry in Transaction Enrichment

As a leading aggregation platform that owns the aggregation process from acquisition to delivery, Envestnet | Yodlee’s aggregation process incorporates approximately 17,000 data sources, touches over 37 million paid users, has over 400 million linked accounts, and supports more than 1,800 firms.

As part of the Envestnet ecosystem, Envestnet | Yodlee is uniquely positioned to offer data coverage that is holistic, broad, and deep. When paired with our sophisticated machine learning techniques, the result is a highly enriched set of digitized transactions with higher transaction categorization accuracy.

With Envestnet | Yodlee Transaction Data Enrichment, consumers not only see a clear merchant name, date, and amount, but they also get additional context—including a simple description of the categories in the transaction data. The information is categorized, augmented, and contextualized with continuous cycles of data training and learnings from billions of transactions contained in the Envestnet | Yodlee Financial Data Platform.

Yodlee Transaction Enrichment is available through Envestnet | Yodlee’s fully hosted FinApps series and API.

Get Started With Transaction Data Enrichment

Drive meaningful digital insights and interactions with enriched and simplified transaction data.

Get Started